A Practical Guide To Investing In Luxury Watches

Buyers Guides

Luxury Watches as investments

Investing in watches is a bit of a controversial topic. Even using the term "investment watch" can conjure images of flippers who are in it to make a quick buck and have no passion for watches. However, if you only focus on that scenario, you miss the bigger picture when it comes to investment watches. The fact is luxury watches are very valuable and that value can increase drastically over time, but that doesn't mean a watch enthusiast can't be both passionate about the art of watchmaking and invest in the watch emotionally and appreciate the investment potential of a timepiece financially. In fact, pouring tens of thousands of dollars into watches with no consideration for the future value of said timepieces is kind of irresponsible. With this guide, we'll aim to teach you about the investment side of watch collecting to help you make more informed decisions.

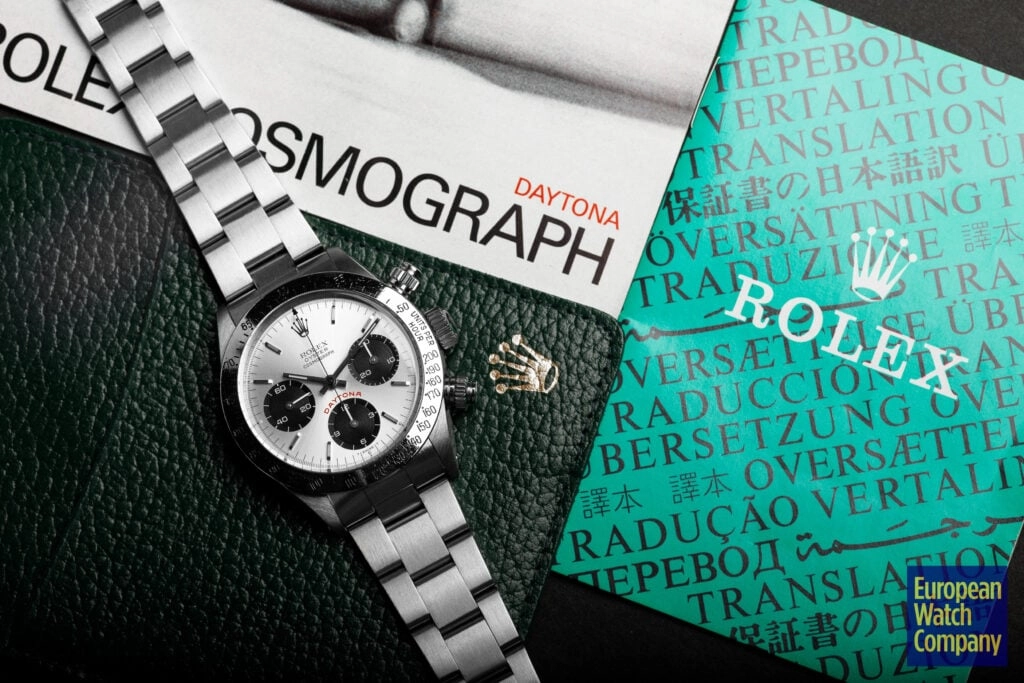

The vintage Rolex Daytona 6265 Big Red

What to consider when buying an investment watch

There are multiple factors to consider when determining the investment viability of timepieces, and we'll get into those in a second, but the first thing to consider is this; no one can predict the future, and no timepiece is guaranteed to be a good investment let alone a great one. Because of this, it's crucial that you actually like the watch and value it at its current price. If the price it costs is worth the happiness it brings you, then you're already getting a return on your investment.

Enjoyment from ownership aside, there are traits that generally make some watches better financial investments than others that one should keep in mind. At the top of the list is scarcity. The fewer examples there are of a particular watch model or perhaps of a model in that condition, the more likely it is that demand for that watch will outpace the supply. When the demand for anything is greater than supply, the value goes up. Watches made in small quantities like limited editions or timepieces from small independent brands like F.P. Journe are good candidates for investment, as are vintage models that were initially unpopular, like the original Audemars Piguet Royal Oak.

The Audemars Piguet Royal Oak 5402ST

The next important factor to consider is the condition. No one will want to buy a timepiece, no matter how rare, if it's damaged beyond all repair. A little patina is great, but too much can spell disaster. Is the case crisp and sharp, or does it have a lot of rounded edges, is the dial cracked, does the movement show signs of rust or pitting? These are all questions you should be asking yourself when examining any used or vintage timepiece. Examine the watch thoroughly and try to compare it to other verified examples in good condition.

Along the same lines as condition, you also need to make sure that the watch is original and authentic, or with a modern timepiece, you need to verify that it's not counterfeit. If it seems too good to be true, it usually is. A watch could be in exceptional condition, but it may have had extensive work done to it to get it that way. A watch could look like it's new old stock but have had its dial, crystal, bezel, and bracelet all replaced and its lugs laser welded, in which case it's not new old stock but heavily refurbished. Even something small like a replacement bezel insert on a vintage Rolex Submariner can drastically affect the watch's current and future resale value. The best way to avoid being duped by a fake or un-original watch is to educate yourself and find a reputable dealer like European Watch Company who can help verify a watch's service history and provenance. The more you know about what a watch has been through and who owned it prior to you, the better.

The F.P. Journe Chronometre Bleu

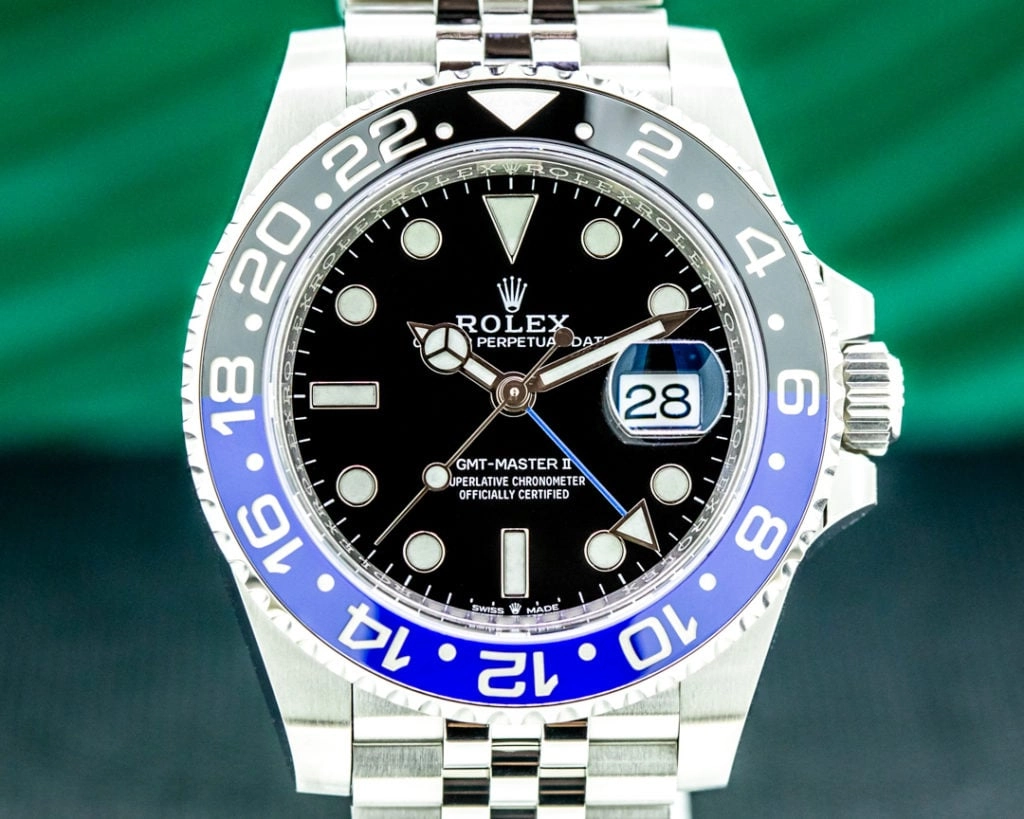

With that in mind, it's important to note that just because a watch has a replacement or service part doesn't mean it's a bad investment. Some watches like an original Rolex GMT-Master 6452 with an original bakelite bezel are so rare that even examples with a replacement bezel have proven to be a good investment. Obviously, an example with its original bezel is worth more than one with a replacement, but those with the proper replacement bezels have still increased in value over the years. The key here is honestly, you want to know what's been replaced, and the watch should be valued accordingly.

Other factors that can come into play in terms of investment viability are brand name and whether the watch is used, new, or vintage. Some brands like Rolex and Patek Philippe have historically performed very well and seen the value of their timepieces steadily climb over the years. Additionally, some watches will make a good investment when bought new, while others are better to purchase slightly used, but we'll get into that in more detail below.

New vs Used

Are new or used watches better for investment? This is a tricky question that depends largely on the timepiece. For many watches, if you buy them brand new, you'll take a hit on the value as soon as you walk out of the store— much like a car—and it could take years, decades even, for it to go from used to vintage. Because of this, it's best to buy many modern watches pre-owned, and let someone else eat the depreciation. Buying the watch at this depreciated price can shorten the time it takes to see a return on your investment.

Now, what about vintage watches, which on paper are used watches? The line between used and vintage can get fuzzy, but generally, a vintage watch is over 25 years old, and these obviously have to be purchased second-hand as they're no longer produced. Vintage watches can make great investments as they're usually more rare and unique than a new or used timepiece. As soon as a timepiece is discontinued, its rarity begins increasing due to watches being destroyed, lost, or just plain aging. Over time, there are fewer good examples of that given model, and if that model becomes desirable by collectors, its price can go up drastically. But the vintage market and the popularity of certain pieces ebbs and flows. We've seen the popularity and value of watches like Rolex Bubblebacks and Paul Newman Daytonas steadily rise, peak, and then decline. If we use the Paul Newman Daytona reference 6239 as an example, the value peaked in May of 2020, hitting the six-figure mark, and then dropping back to the $60,000 range. However, despite the fluctuation in value, Rolex Bubblebacks and Paul Newman Dayton's still sell well above their original retail prices of under $300.

While used and vintage watches are great to look at when investing, they're not the only game in town. Modern watches like the Patek Philippe Nautilus, Audemars Piguet Royal Oak, or almost any modern Rolex are so difficult to obtain at retail that they're instantly worth more after you buy them new. The demand for these timepieces greatly outpaces supply, and some of these watches can be worth two or three times their retail prices on the secondary market. Depending on your desire and pocketbook, these may or may not be risky investments.

The Rolex Daytona 116500LN

Take a Rolex Daytona, for example, which has an MSRP of $13,150 but sells on the secondary market for close to $40,000. Obviously, buying a Daytona at retail—easier said than done—is a great investment because you could turn around and double your money, but is buying a Daytona for, say, $37,500 a good investment? It's hard to say. If we look back four years ago, the Daytona was trading for around $20,000, and as recently as February of 2021, it was selling for about $31,000. In this particular case, even those who bought the watch at a significant premium have seen good returns. If you believe the Daytona will continue to go up in value, then buying the watch at its current value is a no-brainer. However, past performance doesn't necessarily correlate to future performance.

The Patek Philippe Aquanaut 5168G

Where to Buy

Where one should purchase an investment timepiece varies based on the specific model. Like I mentioned above, some watches offer the most profit when they're bought from an authorized seller, but often these watches are very difficult to get and can take a long time to acquire. If you're looking for a vintage or used model, you'll need to do some research and make sure you find a reputable dealer. You want someone who is very transparent about the condition of the watch and has a longstanding reputation in the community. European Watch Company, for example, has been selling watches for almost thirty years and has an impeccable track record as well as possibly the best used and vintage watch inventory you can find.

Another option that could help save you some money and provide you with an accurate history of the timepiece would be to buy directly from the original owner. However, this comes with a couple of big caveats. You need to know and trust someone, who by chance, also happens to be the original owner of a timepiece you're looking for. With no effort on your part, this would basically take a miracle, but if you get involved in your local watch community and build up relationships and friendships, this could be much more feasible.

Watch brands with highest resale value

Branding can be extremely important in terms of investment. A couple of key brands stand out from the pack and have historically performed much better than their peers in terms of holding and growing in value over time. Rolex is probably the best example of this. It's very rare to come across any Rolex watch in good condition that has decreased in value over the long term, and a large majority of their watches have seen dramatic increases in their resale value over the years. Some other brands that have historically performed well in terms of resale value are Patek Philippe, Audemars Piguet, and certain models and watch lines from Omega. Additionally, some very high quality and low production independent manufacturers like F.P. Journe and Philippe Dufour have seen most of their watches increase in value over time.

The Cartier Tank Asymetrique

Watch Models That Likely Will Increase in Value

This is pure speculation on my part so take this with a grain of salt, but these are some watches I think will do well from an investment standpoint in the future. Cartier overall has been increasing in popularity, but I still think its peak is ahead of us, especially if you look at models outside of the usual Tank or Santos lines. In particular, I think these two Tonneau Cintree models will appreciate nicely. Here is a vintage yellow gold Tonneau Cintree from 1988 that is in excellent condition with a manually wound movement and a gorgeous "Paris" stamped silver guilloche dial, selling for $11,500. Because it's not a flagship model from Cartier, and it's from the late 80's I believe it's getting undervalued. Similarly, this modern platinum Tonneau Re-Edition is one of just 100 examples with a silver sunray finished dial and a beautiful red cabochon on the crown. It's a modern watch that's selling for $22,500, which is about $4,000 less than its original retail price, meaning someone else already took the depreciation hit for you. A Cartier this good-looking and rare is very likely to become a future classic.

The Vacheron Constantin Triple Date Cornes De Vache 4240

I would also direct your attention to vintage Vacheron Constantin. You can get excellent examples of important and historical models like this Cornes De Vache Triple Date for $22,000. This vintage reference 4240 is what Vacheron based their Cornes De Vache re-edition off of, and it was the brand's first serially produced calendar wristwatch. It's a handsome watch with some serious history, and because it's not a Patek Philippe or Audemars Piguet, it gets a little overshadowed, which is good from an investment standpoint.

The Tudor Heritage Black Bay P01

Last but not least is the controversial Tudor P01. This is a lightning rod of a watch in the collecting community. Yes, it's odd-looking but don't forget this is a Rolex family dive watch with a military-inspired backstory, and it has a rock-solid in-house movement that will undoubtedly outlast you. Its unique aesthetic and utilitarian nature mean it's not for everyone, and that's great for our purposes here because I believe that its lack of popularity will lead to it being collectible down the road. This may sound counterintuitive but remember that part of the reason the Paul Newman Daytona is so sought after now is that it was relatively unpopular during its production run. If this unpopular P01 suddenly becomes highly desirable, its supply likely won't be able to keep up with demand, and its price will climb quickly. Plus, with a current second-hand price of around $3,650, it makes for a low-risk investment.

Best time to sell an investment watch

When it comes to investing, the standard rule is to buy low and sell high, but we're not always sure what low and high are for any given asset. However, if you follow the market and pay attention to trends, you can use this knowledge to help inform the timing of the sale. Keep an eye on your specific reference and track the value of the watch over time. Generally, if the value of a timepiece is rising, it's a good time to sell. If you continue to wait for the peak to try to maximize your profit, you might not pull the trigger quick enough and be left holding the bag. The only way to ensure you make a profit is to sell the watch as soon as its value is worth more than you paid for it. Spend wisely, my friends.